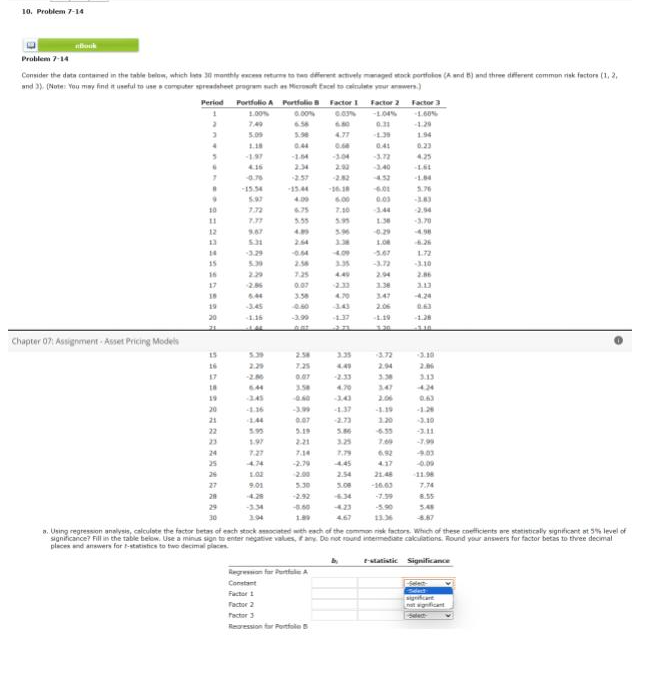

10. Problem 7-14 ebook Problem 7-14 Consider the data contained in the table below, which lasts 30 monthly excess returns to two different actively managed stock portfolios (A and B) and

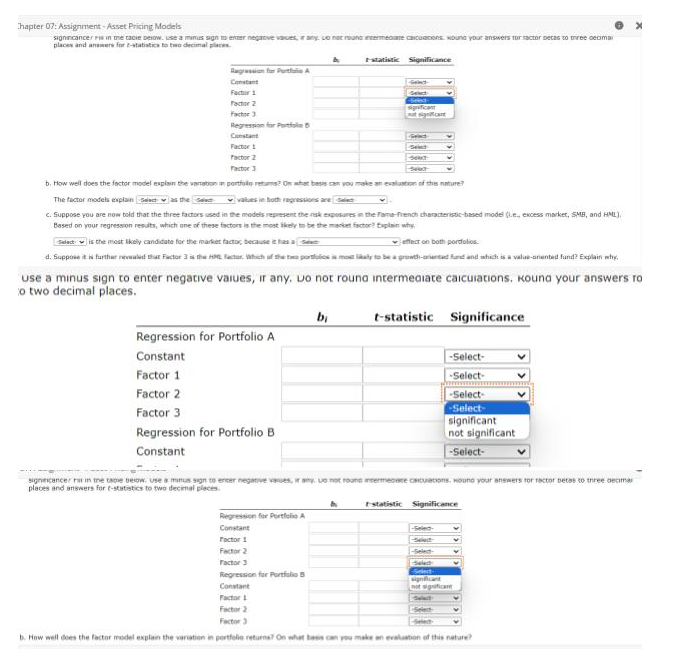

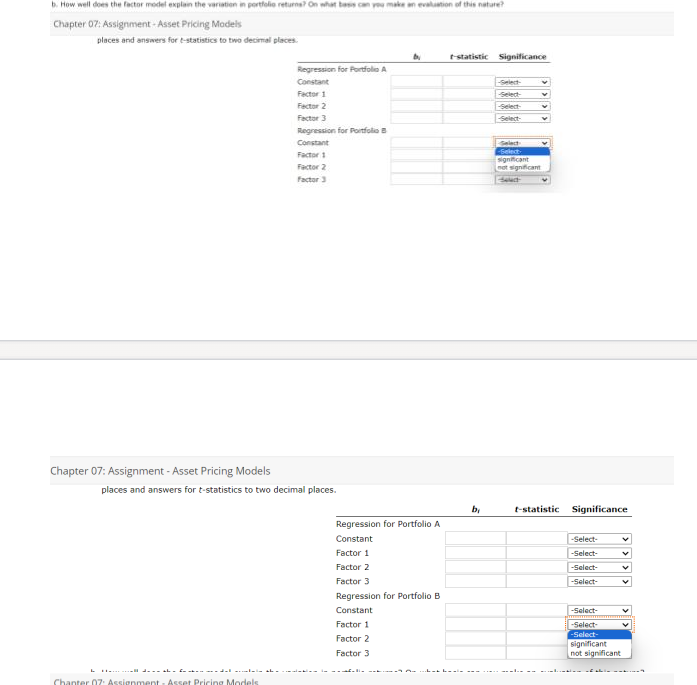

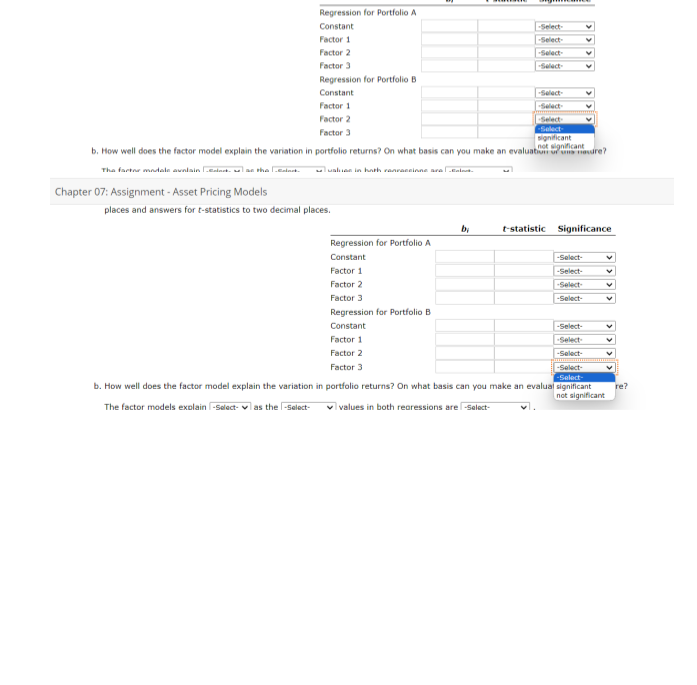

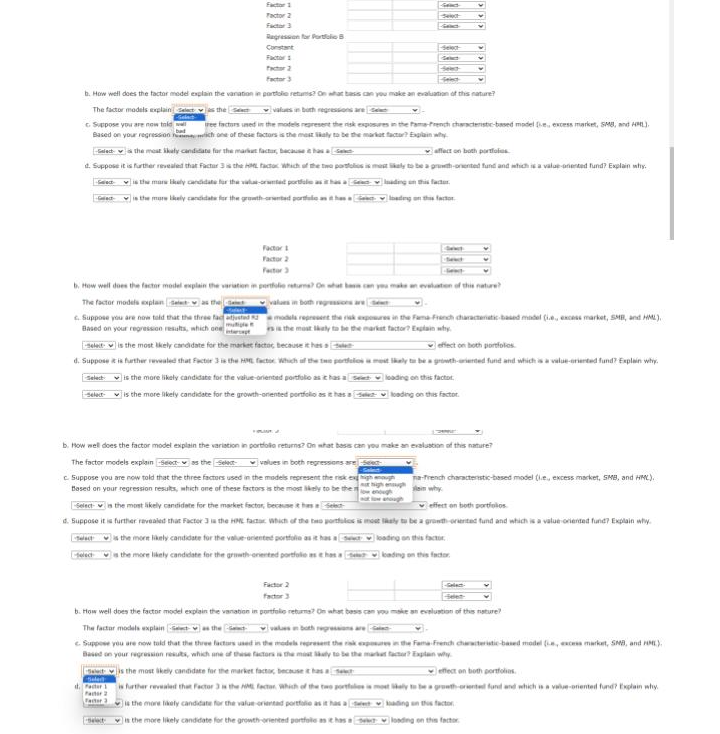

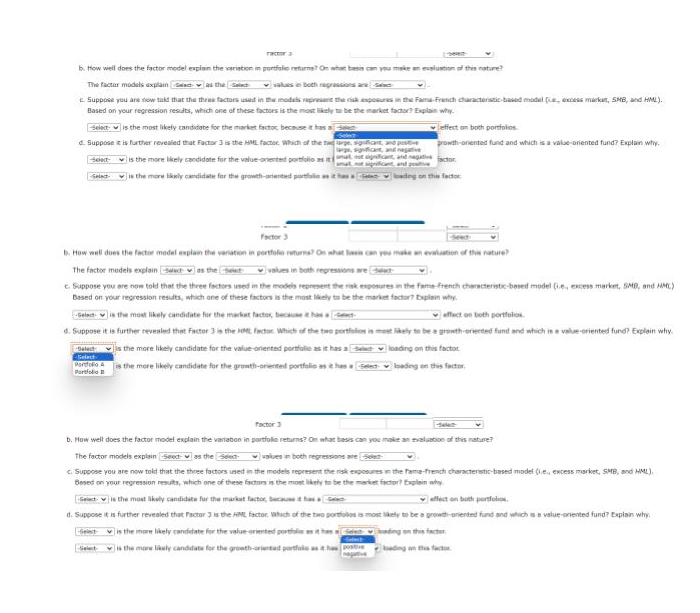

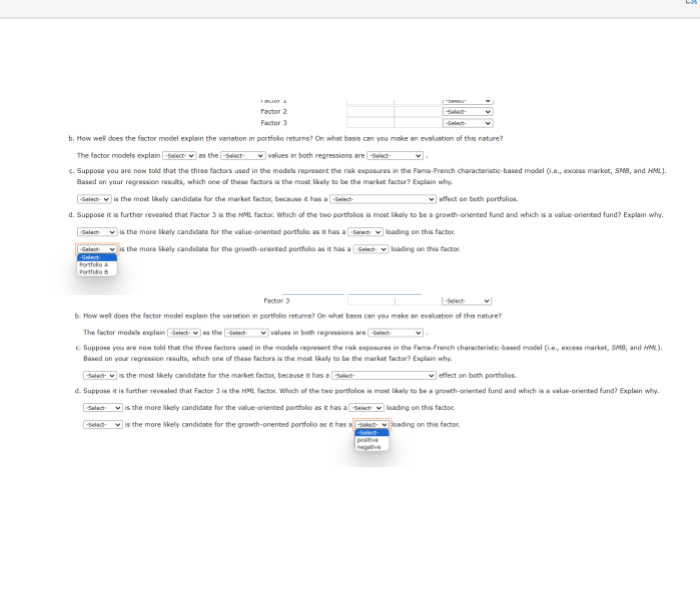

three different common risk factors (1, 2, and 3). (Note: You may find it useful to use a computer spreadsheet program such as Microsoft Excel to calculate your answers.) Chapter 07: Assignment-Asset Pricing Models Period 1 2 3 4 3 7 . 10 11 12 13 14 15 17 19 19 20 71 15 BADEERANA 16 17 18 20 21 22 23 24 25 25 27 29 Portfolio 1.00% 7.49 5.09 1.18 -1.97 4.15 -0.76 -15.54 5.97 7.72 9.67 -3.29 5.30 2.29 -2.96 6.44 -3.45 LAL 5.39 2.29 -2.80 6.44 -3.45 5.95 1.97 7.27 4.74 1.02 9.01 -3.34 1.94 Portfolio B Factor I Factor 2 0.00% 0.03% -1.04% 6.58 0.31 0.44 2.34 -2.57 -15.44 4.09 6.75 3.55 4.39 2.64 -0.04 2.56 0.07 3.58 -3.90 2.58 7.25 0.07 3.58 -3.99 0.07 5.19 2.21 -2.00 5.30 Regression for Portale A Constant 4.77 Factor 1 Factor 2 Factor 3 Regression for Portfole 2.92 -16.18 7.10 3.38 3.35 4.70 -1.37 3.35 4.49 4.70 -3.41 -1.37 -2.73 4.45 2.54 5.08 0.41 b -3.40 0.03 1:36 -0.29 1.08 -3.72 2.94 3.36 1.30 -3.72 2.94 3.38 347 -1.39 1.20 7.69 6.92 4.17 21.48 -16.63 Factor 3 -1.60% 1.94 0.23 4.25 -161 -1.04 5.76 -2.54 -3.70 -4.98 -8.26 1.72 -3.10 3.13 0.63 -1.28 -3.10 2.06 3.13 4.24 0.63 5.45 1.39 13.36 -4.87 a. Using regression analysis, calculate the factor betas of each stock associated with each of the common risk factors. Which of these coefficients are statistically significant at 5% level of significance? Fill in the table below. Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers for factor betas to three decimal places and answers for t-statistics to two decimal places -1.28 -3.10 -3.11 4.03 -0.09 -11.98 7.74 -statistic Significance Select significant not significant/nChapter 07: Assignment-Asset Pricing Models signincancer in the tacie pelow. use a minus sign to enter negative values, ir any vo net round intermediate cacuations wound your answers for actor pecas to three decima places and answers for t-statistics to two decimal places. statistic Significance Regression for Purtule A Constant Factor 1 Factor 2 Factor 3 Regression for Portfolio Constant Factor 1 Factor 1 Factor 2 Factor 3 Regression for Portfolio A Constant -Sect Factor 2 Factor 3 Select b. How well does the factor model explain the variation in portfolio retums? On what besis can you make an evaluation of this nature? The factor models explain Select as the select values in both regressions are t c. Suppose you are now told that the three factors used in the models represent the risk exposures in the Fame-French characteristic-based model (ie, excess market, SMB, and HML), Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why Regression for Portfolio B Constant Select is the most likely candidate for the market factor because it has a effect on both portfolios. d. Suppose it is further revealed that Factor 3 is the HPL factor Which of the two portfoliosis most likely to be a growth-oriented and and which is a value-oriented fund? Explain why use a minus sign to enter negative values, ir any. Do not rouna intermediate calculations. Kound your answers to o two decimal places. t-statistic Significance b Regression for Portfolio A Constant Factor 1 Factor 2 Factor 3 bi Regression for Portfolio B Constant GENT -Select- significant bi V ✔ signincancer it in the table below. use a minus sign to enter negative values, ir sny. Lo not found intermecere calculations. Hound your answers for factor tetas to three decima places and answers for t-statistics to two decimal places. -Select- -Select- -Select- -Select- significant not significant -Select- -Select Select t-statistic Significance Select Select significant not significare Factor 1 Factor 2 Factor 3 Select Seet b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature?/nb. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? Chapter 07: Assignment-Asset Pricing Models places and answers for t-statistics to two decimal places. Chapter 07: Assignment-Asset Pricing Models Regression for Portfolio A Constant Chapter 07: Assignment-Asset Pricing Models Factor 1 Factor 2 Factor 3 Regression for Portfolio B Constant Factor 1 Factor 2 Factor 3 places and answers for t-statistics to two decimal places. Regression for Portfolio A Constant Factor 1 Factor 2 Factor 3 Regression for Portfolio B Constant Factor 1 Factor 2 Factor 3 t-statistic Significance b₁ -Select- -Select- -Select- -Select- Select -Select- significant not significant Select t-statistic Significance -Select- -Select- -Select- -Select- -Select- -Select- -Select- significant not significant/nRegression for Portfolio A Constant Factor 1 Factor 2 Factor 3 Chapter 07: Assignment - Asset Pricing Models Regression for Portfolio B Constant Factor 1 Factor 2 Factor 3 -Select- significant b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluations more? The factor modale avolain Elect, sean the „Esinet. selualuen in hath rancaccinne ara | „Esinet- places and answers for t-statistics to two decimal places. Regression for Portfolio A Constant Factor 1 Factor 2 Factor 3 Regression for Portfolio B Constant -Select- -Select- -Select- -Select- by -Select- -Select- significant t-statistic Significance -Select- -Select- -Select- -Select- -Select- Factor 1 -Select -Select- Factor 2 Factor 3 -Select- -Select- b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evalual significant The factor models explain -Select- as the -Select-values in both regressions are-Select- not significant re?/nFactor 2 Factor 3 Regression for Portfolio B Select 3 Sret b. How well does the factor model explain the vanation in portfolie retums? On what bass can you make an evaluation of this nature? as the values in both regressions are e The factor models explain Select c. Suppose you are now told tree factors used in the models represent the risk exposures in the fame-French characteristic-based model -e, excess market, SMB, and HML). ich one of these factors is the most likely to be the market factor? Explain why Based on your regression -Select the most skaly candidate for the market factor, because it has a sec affect on both portfolios d. Suppose it is further revealed that Factur 3 is the HML factor Which of the two portfolios is mest ikely to be a growth-oriented fund and which is a value-oriented fund? Explain why Selects the mars Ekely candidate for the value-oranted portfule as it has a loading on this factor is the more likely candidate for the growth-oriented portfolio as it has a loading on this factor Factor 2 Factor 3 New b. How well does the factor model explain the variation in portfolio returns? On what ban can you make an evaluation of this nature? The factor models planetas the c. Suppose you are now told that the three faceted Based on your regression results, which one intrat select is the most likely candidate for the market factor, because the models represent the risk exposures in the Fama-Franch characteristic-based model (ie, excess market, SMB, and HML), is is the most likely to be the market factor? Explain why effect on both portfolios d. Suppose it is further revealed that Factor 3 is the HM factor Which of the two portfolios a mostly to be a growth-oriented fund and which is a value-oriented fund? Explain why. Select is the more likely candidate for the value-oriented portfolio as it has a seloading on this factor is the more likely candidate for the growth-oriented portfolio as it has a select loading on this factor. b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explain eect was the Select values in both regressions are sent ugh c. Suppose you are now told that the three factors used in the models represent the risk ex high enough Based on your regression results, which one of these factors is the most likely to be the na-french characteristic-based model (le, excess market, SMB, and HMC). why -Select-is the most likely candidate for the market factor, because it has Select effect on both portfolios d. Suppose it is further revealed that Factor 3 is the HMC factor Which of the two portfolios is most likely to be a growth-oriented fund and which is a value oriented fund? Explain why. elects the more likely candidate for the value-oriented portfolio as it has a -telects the more likely candidate for the growth-oriented portfolio as e has a loading on this factor loading on this factor Select b. How well does the factor model explain the vanation in portfolio returns? On what besis can you make an evaluation of this nature? The factor models explain Sect as the values in both regressions are a c. Suppose you are now told that the three factors used in the models represent the risk exposures in the Fama French characteristic-based model (ie, excess market, SMB, and PMC). Based on your regression results, which one of these factors is the most haly to be the market factor? Explain why is the most likely candidate for the market facto, because it has a effect on both portfolios. d. Pacter 1 is further revealed that Factor 3 is the AM factor. Which of the two portfales is most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why Factor 2 Factor 3 is the more likely candidate for the value-orientad portfolio as it has a loading on this factor is the more likely candidate for the growth-oriented portfold as it has a loading on this factor/nractor 3 b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explains the values in both regressions are sec Suppose you are now told that the three factors used in the models represent the risk exposures in the Fama-French characteristic-based model (e, excess market, SMB, and HML). Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why -Select- is the most likely candidate for the market factor because it has d. Suppose it is further revealed that Factor 3 is the HML factor Which of the targe, significant, and positive arge, significant, and negative -Select is the more likely candidate for the value-oriented portfolio as it cand a -Select is the more likely candidate for the growth-oriented portt effect on both portfolios growth-oriented fund and which is a value-oriented fund? Explain why. factor Factor 3 b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explain Sect as the values in both repressions are select c. Suppose you are now told that the three factors used in the models represent the risk exposures in the Fame-French characteristic-based model (ie, excess market, SMB, and MMC) Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why -Gelect is the most likely candidate for the market factor, because it has act effect on both portfolios d. Suppose it is further revealed that Factor 3 is the ML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why. Selects the more likely candidate for the value-oriented portfolic as it has a Select loading on this factor Por is the more likely candidate for the growth-oriented portfolio as it has a loading on this factor Portfolio Factor 3 b. How well does the factor model explain the variation in portfolio returns? On what besis can you make an evaluation of this nature? The factor models explain -Select- as the select values in both regressions are elect c. Suppose you are now told that the three factors used in the models represent the risk exposures in the fame-french characteristic-based model (ie, excess market, SMB, and HML). Based on your regression results, which one of these factors is the most likely to be the market factor? Exp -Seat is the most likely candidate for the market factor, because it has a effect on both portfolios d. Suppose it is further revealed that Factor 3 is the AME factor. Which of the two portfoliosis most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why -Select-is the more likely candidate for the value-oriented portfolie as it has a leading on this factor Select is the more likely candidate for the growth-oriented portfolio as it has loading on this factor/nFOUR & Factor 2 Factor 3 -Select- b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explain -Select- as the -Select- values in both regressions are select c. Suppose you are now told that the three factors used in the models represent the risk exposures in the Fama-French characteristic-based model (i.e., excess market, SMB, and HML). Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why. "DEMELE -Select- is the most likely candidate for the market factor, because it has a-Select- effect on both portfolios. d. Suppose it is further revealed that Factor 3 is the HML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why. -Select is the more likely candidate for the value-oriented portfolio as it has a select loading on this factor is the more likely candidate for the growth-oriented portfolio as it has a select loading on this factor -Select- Portfolio A Portfolio B Factor 3 b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explain -Select- as the elect values in both regressions are c. Suppose you are now told that the three factors used in the models represent the risk exposures in the Fama-French characteristic-based model (ie, excess market, SMB, and HML). Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why. -Select- is the most likely candidate for the market factor, because it has a select effect on both portfolios. d. Suppose it is further revealed that Factor 3 is the HML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why. Select is the more likely candidate for the value-oriented portfolio as it has a Select loading on this factor -Select- is the more likely candidate for the growth-oriented portfolio as it has a -Select-loading on this factor